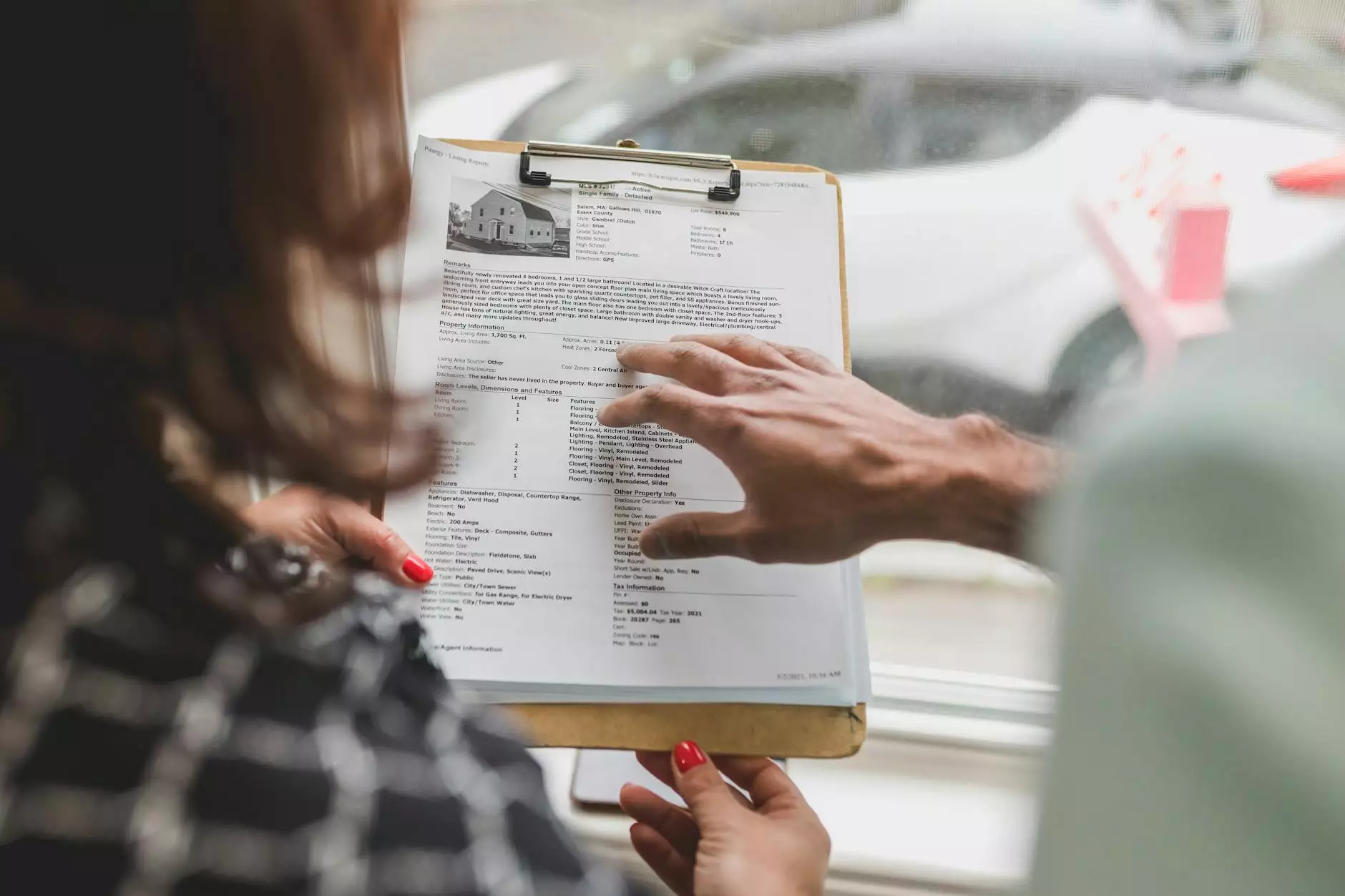

Lining Up Your Escrow Paperwork For Homebuyers

Alerts

Introduction

Welcome to Hotline Realty, your trusted partner in the real estate industry. In this comprehensive guide, we will walk you through the process of lining up your escrow paperwork as a homebuyer. Escrow paperwork plays a crucial role in ensuring a smooth and secure real estate transaction. Let's delve into the details!

Understanding Escrow

Before we dive into the specific paperwork requirements, let's briefly explain what escrow is. Escrow refers to a process where a neutral third party holds important documents and funds during a real estate transaction. It ensures that both the buyer and seller fulfill their respective obligations before completing the deal.

Common Escrow Documents

Preparing your escrow paperwork involves gathering several essential documents. Here are some of the most common documents required:

1. Purchase Agreement

The purchase agreement is a legally binding contract between the buyer and seller. It outlines the terms and conditions of the purchase, including the purchase price, contingencies, and closing date. Make sure all parties involved review and sign this document to proceed with the escrow process smoothly.

2. Loan Documents

If you're financing your home purchase, you'll need to gather all the necessary loan documents. These may include loan applications, pre-approval letters, and any additional documents required by the lender. It's essential to provide accurate and up-to-date information to expedite the loan approval process.

3. Property Title

Verifying the property title is crucial to ensure a clear and marketable title. Your escrow officer will help you obtain the title report and review it for any potential issues such as liens, encumbrances, or legal disputes. Clearing any title issues beforehand will prevent complications during the escrow process.

4. Home Inspection Reports

A home inspection report provides a comprehensive analysis of the property's condition. It covers aspects like structural integrity, electrical systems, plumbing, and more. Reviewing the inspection report allows you to address any necessary repairs or negotiate with the seller for suitable solutions.

5. Insurance Policies

Purchasing homeowner's insurance is essential to protect your investment. Provide copies of your insurance policy and ensure it meets the lender's requirements. The escrow officer will coordinate with the insurance provider to update the policy details for a seamless closing process.

Organizing Your Escrow Paperwork

To streamline the escrow process, it's important to keep your paperwork organized. Here are some tips to help you stay on top of your documents:

1. Create a Checklist

Develop a checklist of all the required documents and mark them off as you gather them. This will ensure you don't miss any crucial paperwork during the hectic process of buying a home.

2. Make Copies

Make multiple copies of all your documents and keep them in a secure location. Having extra copies will come in handy if any issues arise or if additional copies are required for various parties involved.

3. Utilize Digital Storage

Consider scanning your documents and storing them digitally in a secure cloud storage system. This ensures easy access and prevents the risk of losing important paperwork.

Conclusion

Successfully lining up your escrow paperwork is crucial for a seamless homebuying experience. By understanding the necessary documents and organizing them effectively, you can ensure the process moves forward smoothly. Hotline Realty is dedicated to assisting you throughout the entire real estate journey, from finding your dream home to closing the deal. Contact us today and let our team of experts guide you through the escrow process stress-free!